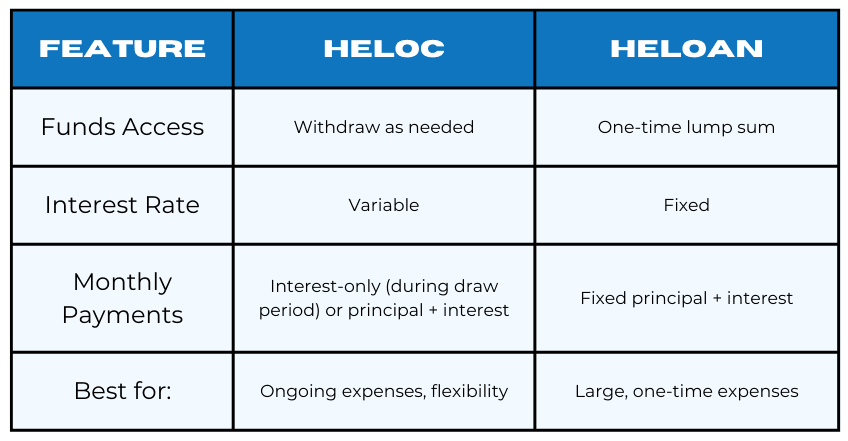

HELOC vs. HELOAN

Your home is more than just a place to live—it’s a powerful financial asset. If you’re looking to access cash for home improvements, debt consolidation, or other major expenses, a Home Equity Line of Credit (HELOC) or a Home Equity Loan (HELOAN) could be the perfect solution. Let’s break down what these options are, how they work, and which one might be right for you.

What is a HELOC?

A Home Equity Line of Credit (HELOC) is a flexible, revolving line of credit that allows you to borrow against the equity in your home. Think of it like a credit card—you're approved for a set limit, but you only borrow what you need, when you need it.

Key Features of a HELOC:

- Revolving Credit Line: Borrow as much or as little as you need, up to your approved limit.

- Variable Interest Rates: Rates can fluctuate based on market conditions.

- Draw Period & Repayment Period: Typically, you can borrow for 5-10 years (draw period) and then repay over 10-20 years.

- Interest-Only Payments: During the draw period, you may have the option to make interest-only payments, keeping monthly costs low.

- Great for Ongoing Expenses: Ideal for home renovations, tuition, or unexpected expenses where you need access to funds over time.

What is a HELOAN?

A Home Equity Loan (HELOAN), also known as a second mortgage, allows you to borrow a lump sum of money using your home's equity. Unlike a HELOC, a HELOAN provides a fixed interest rate and predictable monthly payments.

Key Features of a HELOAN:

- Lump-Sum Payment: Receive all your funds upfront.

- Fixed Interest Rates: Your interest rate remains the same throughout the life of the loan.

- Set Repayment Term: Typically 5-30 years with regular monthly payments.

- Best for One-Time Expenses: Ideal for major expenses like debt consolidation, medical bills, or a large home improvement project

Why Use Your Home's Equity?

Using your home’s equity can be a smart financial move because:

- Lower Interest Rates: HELOCs and HELOANs typically have lower rates than personal loans or credit cards.

- Potential Tax Benefits: Interest may be tax-deductible if used for home improvements (consult your tax advisor).

- Increase Home Value: Using funds for home renovations can improve your property’s worth over time.